Share Investing - Mechanics

How Shares are Traded

How Shares are Traded

Last week I attempted to answer the question "what is a share?", this week I explain how they are traded to help work out what price we should pay for a share.

The price of something is determined by a buyer and a seller agreeing on a price for a given quantity of that something, and a trade occurring. With shares the stock exchange is where buyers and sellers meet to decide on prices. In New Zealand the stock exchange is called the NZX, which is a listed company in it's own right. The actual mechanics of the trade are carried out by share brokers. So if you want to buy or sell shares you will need to open an account with a broker. Click here to download a form to open an account with Bay Financial Partners .

Once a share is listed on the stock exchange no one person decides what the price of that share will be. People come to the market wishing to either buy or sell a certain quantity of shares at a certain price. Of course no buyer wants to pay too much and no seller wants to receive too little. How you decide what price you should pay for a share will be the topic of the next article but first you may find it useful to understand the mechanics.

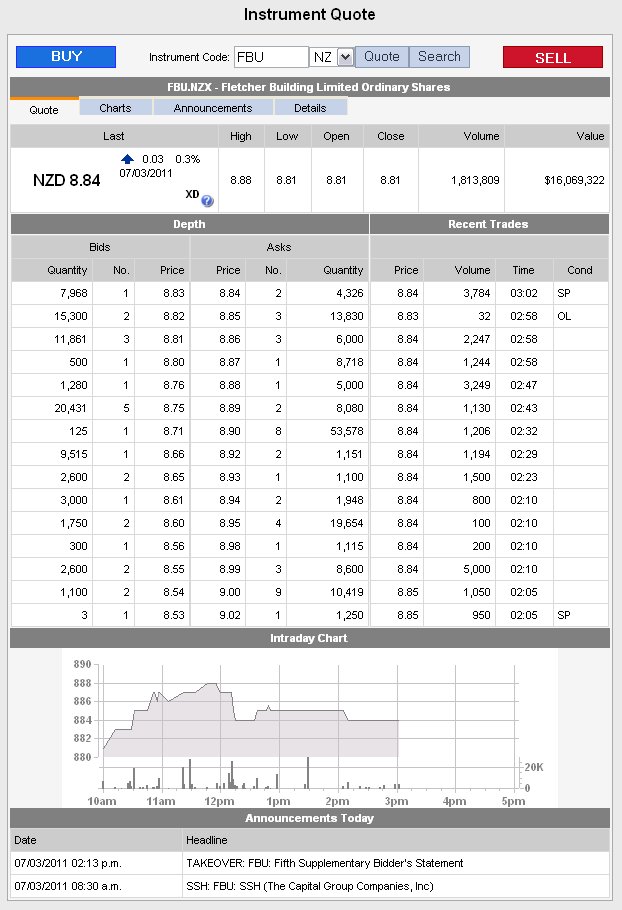

Below is a screen shot of the share market quotes on the New Zealand Stock Exchange for Fletcher Building Limited at a particular point in time on 7 March 2011. As one of New Zealand's largest companies this share trades often and in comparatively large volumes, large by New Zealand standards, still pretty small by world standards.

The last sale price is in big bold letters towards the top and recent price and activity information is displayed along side.

On the right under Recent Trades are sales that have actually gone through, the price they traded at, how many changed hands and at what time.

On the left under Depth are figures showing the Bids and Asks.

Under Bids we are looking at the buy side. We can see on the first line that one buyer is prepared to pay $8.83 for 7,968 shares, the next line says that there are two people who are prepared to pay $8.82 and their orders total 15,300 shares, and so on.

Under Asks we are looking at the sell side, what people are asking for their shares. The first line tells us there are two people with a tiotal of 4.326 shares who will sell at $8.84, three people who are prepared to pay $8.85 for a total of 13,830 shares and so on.

We never see the same price on the Bid and Ask side as if they match up the computer system instantly matches them up and they hop over to the right side as a Recent Trade.

If we put in an order to buy 10,000 "at market" we would get 4,326 at $8.84 and the remainder of 5,674 at $8.85. Then two trades would appear on the right side. If we put in an order to buy 10,000 at $8.80 our bid would be added to the existing bid at fourth on the list and that line would change to read 10,500 2 $8.80. Our bid will sit there until all the previous higher prices are satisfied or we change our bid.

Orders at the same price are satisfied in the order they are placed.

We can read all sorts of things into this page by comparing the volumes and prices that people are prepared to buy at with those people are prepared to sell at. At this stage buyers considerably outweigh sellers, one might conclude that means that as there is more demand than supply the price will go up and it will if the buyers decide to pay more but of course it wont if they don't. A good share broker will look at a page like this and his experience and training will lead him to conclude which way the price is likely to move and by how much and then assist you to place your order at a suitable level.

If your price is met your trade will be matched off and the the broker will send you a contract note with the details of the transaction and how much you owe or will receive. Once the money changes hands the broker will send off instructions to the companies share registry to transfer the share from the seller to the buyer. A week or two later both parties will get a statement from the share registry confirming that shares have changed hands.

Next we'll explain how to determine what price you might pay for a share using Share Investing - Fundamental Analysis

- Last updated on .