Rational Investing

According to Warren Buffett, the world’s most successful investor -

According to Warren Buffett, the world’s most successful investor -

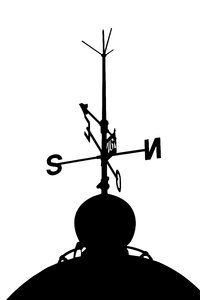

“You can’t get rich with a weather vane” - or by swinging with the breeze.

Apart from his unique talents in spotting, buying and extracting value from good investments, Buffett also has a unique ability to pass on his knowledge in simple terms. So simple that small private investors can benefit from following his advice at a local level. He believes that when buying shares you don’t just invest - you buy a piece of a business.

We live in volatile times, with prices & values changing rapidly on the share market often without any apparent sense for many of us. New Zealand is also a very small market with not a lot of companies publicly listed, there are only a handful of billionaires here, and not all that many institutional investors, so there are a lot of small private investors involved in buying and selling shares. It would be naïve to believe small investors have the same access to information as the big players, or that the majority of small investors are always making rational decisions on buying or selling - so some general principles from Buffett can be quite useful.

“The market is there only as a reference point to see if anybody is offering to do anything foolish. When we invest in stocks, we invest in businesses” he says. So the initial rule must be: Is it a good business? The follow on question: Are there any foolish sellers of this business? That is, if the company is financially sound, and is continuing to make money for its owners, yet there are investors willing to sell it at a discount to its real value - doesn’t that present an opportunity?

It does if the investor knows how to answer those questions and then has the confidence - or self-belief - to act upon it. Buffet has also said: “the future is never clear, you pay a very high price in the stock market for a cheery consensus. Uncertainty actually is the friend of the buyer of long term values”. Bear in mind that many times “the crowd” is making a rational decision on the worth of a business, but there are also many times that “the crowd” is not rational (remember the tech wreck?).

So in volatile times when prices are up & down dramatically or rapidly, there is opportunity for the staunch, ratioinal, value driven investor. Prices often soar or free fall according to the news- ever noticed that? No-one ever says “another average day on the sharemarket, most of the companies continued making money for their owners today”.

Drama and volatility can be good - as long as investors can make value judgements about the merits of a share, determine when the price is out of line with the value of the business, and have the courage to lean against the breeze. First be rational, then be patient. Or in Buffet’s words again: “You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Rationality is essential” – but he cautions: “valuing a business is part art and part science”. How investors determine the value of a share can depend on a number of business variables, personal opinions and beliefs of the future - there isn’t one easy & right formula.

If of course this is too difficult, or you lack the confidence to do it directly, then it makes sense to consider getting professional financial advice about the merits of using different types of managed funds that can access the market for you.

- Last updated on .