Sorting the Wheat from the Chaff

We received the following article from Harbour Asset Management pointing out some issues around NZ Fixed Interest Securities which they have kindly allowed us to reproduce. If you are interested in investing in Harbour Asset Management funds please contact one of our advisers on 07 578 3863 or email

Harbour Asset Management started with five members of a New Zealand domiciled Australasian equities investment and research team from a global investment management firm that over the prior ten years had managed between $900m and $1.5bn in Australasian equities. As at 31 December 2010, Harbour managed over $700m in Australasian equities. In January 2011 Harbour launched a fixed interest service for both retail and wholesale clients. The fixed interest team experience includes managing both New Zealand and foreign bond portfolios in excess of $2bn. The team commenced with over $75m in bonds under management.

Harbour Asset Management can be found at www.harbourasset.co.nz

Subordination, Reset Risk and Embedded Call Options in NZ Debt and Capital Securities

New Zealand Fixed Income Research

New Zealand Fixed Income Research

15 August 2011 |

- In the aftermath of the collapse of certain CDO funds and finance companies, retail investors have directed their search for income towards other available fixed interest securities.

- Amongst the most popular have been some of the more complex securities offered in New Zealand. This includes securities with features such as subordination, coupon resets or uncertain maturity dates. These features have led to quite divergent market performance.

- These securities require disciplined and expert analysis, plus an appreciation of the nature of subordination and the effects of market volatility. Despite these challenges, they can have a role to play in a well-constructed portfolio. They also play an important role in the New Zealand capital market.

- Regulatory and tax changes have spurred a trend towards investing in fixed interest funds instead of direct holdings by retail investors. This may reduce overall demand for the lower-tier part of the market. There may be an opportunity for fund managers to increase their activity in this area.

Sorting the wheat from the chaff

In olden times, farmers used the technique of winnowing, where they would fan or toss their wheat in the wind so that the useless chaff would blow away. The price of a sack of wheat with chaff in it would not fetch the price of a winnowed sack. And so it is in fixed income markets. However, while it may be simple for nearly anyone to pick up a handful of grain and get a sense of the quality, things are not so easy with fixed income securities. In New Zealand, as elsewhere, many securities have features which are not well appreciated, even by professional investors. People have been repeatedly caught out, as they underestimated or didn‟t take the time to build a deep understanding of a security‟s true character.

In this article we look at three security characteristics that are widespread and not well appreciated in New Zealand: subordination, call options and coupon rate resets. Nearly half of the securities traded on NZDX (the debt-trading section of NZX) have one or more of these features. We then examine how these security-types behave when market volatility increases. Finally, we consider if and how to incorporate them in a portfolio. The conclusion is that the complexities embedded in these securities can be analysed, that risk can be managed, but that this requires time, expertise and resources. It is an often observed paradox that these securities are largely held by retail investors.

Fixed Income Security Characteristics

A debt security‟s characteristics can be broken down into various facets, among which include:-

i. Seniority

ii. Coupon

iii. Maturity

iv. Credit Spread

v. Liquidity

vi. Duration

vii. Credit Rating

viii. Documentation features

ix. Regulatory issues

We are going to focus on the first three of these, (seniority, coupon and maturity) and explain how market volatility affects security performance. This also involves discussion of credit spreads and liquidity. In this note, for the purposes of general information and illustration only, we will selectively use examples of fixed interest-type securities. At no time are we either providing financial advice or making a recommendation on a specific security (Please refer to the Important Notice and Disclaimer).

Table 1. A cross-section of certain widely held NZ securities. Features vary from security to security.

|

Issuer |

Current |

Maturity |

Seniority |

Callable |

Coupon Reset |

Margin above Govt |

|

Fonterra |

7.75% |

March 2015 |

Senior |

No |

Fixed |

0.97% |

|

Rabobank |

6.32% |

April 2014 |

Senior |

No |

Fixed |

1.00% |

|

Rabobank |

4.211% |

Perpetual |

Subordinate |

Yes |

Annual |

4.14% |

|

Rabobank |

8.78% | Perpetual | Subordinate | Yes | 5 Years | 2.67% |

|

Quayside |

5.42% |

Perpetual |

Senior |

Yes |

3 Years |

2.27% |

|

Sky TV |

4.06% |

October 2016 |

Senior |

No |

Annual |

2.70% |

|

ANZ |

9.66% |

2.52% |

Subordinate |

Yes |

5 Years |

2.60% |

|

Credit Agricole |

10.035% |

Perpetual |

Subordinate | Yes |

5 Years |

7.66% |

|

CBA Capital |

3.59% |

April 2015 |

Subordinate | Yes | Annual | 2.45% |

Source: NZX, Harbour Asset Management Ltd

* Note: Margin to assumed call date is estimated by Harbour Asset Management as at 30 June 2011.

i) Subordination

On the face of it, subordination is pretty simple. Subordinate debt is debt that ranks below other securities with regard to claims on assets or earnings. In the case of default, creditors with subordinated debt do not get paid out until after the senior debtholders are paid in full.

In assessing the risk of loss from any bond, we want to estimate both the probability of default and the proportion of accrued income and principal we might lose. When a senior rated bond defaults and this leads to liquidation of the issuer, the market has traditionally assumed there will be some recovery of principal once the firm‟s assets are sold. A recovery rate of 30-50% is a conventional estimate. However, for subordinate debt a zero recovery is more likely, as it bears losses before any senior debt holder does.

.jpg) Source: ANZ, NZX, Harbour Asset Management. Data are Harbour estimates as at 30 June 2011.

Source: ANZ, NZX, Harbour Asset Management. Data are Harbour estimates as at 30 June 2011.

A really powerful way to look at the probability of default was developed by Robert Merton, for which he was awarded the Nobel Prize. His “Merton Model” uses an option pricing framework where the key insight was to consider the volatility of the value of a firm. In its simplest form, the idea is that the more volatile a company‟s worth, the greater the chance that the firm‟s equity is worth zero and the company defaults. As subordinate debt sits between equity and senior debt on the capital structure, equity price volatility will affect the price of subordinate debt. In other words, when equity markets are under stress, subordinate bonds will underperform senior bonds. In the context of a balanced portfolio, where the fixed income allocation is designed to counter the equity market volatility, subordinate bonds can be at risk of failing to do the job.

Subordination: A closer look

The Merton framework can also be used to understand the risk of securities that are structurally subordinate. Examples of structural subordination in New Zealand include GPG Finance Plc Infratil Limited and Prime Infrastructure Networks (NZ) Ltd. Each of these companies hold equity positions in a portfolio of companies. So while their debt may be a senior obligation of the issuing company, this debt must ultimately be serviced by the value of the equity positions held, which are the assets of the company. Therefore Infratil‟s debt can be said to be structurally subordinate to debt issued by Trustpower, Z Energy and Wellington International Airport, as they are companies partly owned by Infratil. We can learn something about the risk of Infratil debt by observing the volatility of Trustpower equity prices.

Finance companies in New Zealand were also structurally subordinate in many cases. Their exposure to property development was an example, where the finance company lending was often ranked behind senior lending by the banking sector. Under stress, bank losses were far smaller than those made by finance companies.

The documentation of a security is important for subordination. In default, power is most strongly held by senior debt holders, which typically includes bank lenders. They can have significant influence over the liquidation process and their incentives may not be aligned with sub-debt holders. While sub-debt may have a trustee looking after their interests, their powers may be constrained and include no voting rights. Documentation will explain the rights and powers held by subordinate debt holders in this situation.

Bank sub-debt has its own regulatory complication. Following the financial crisis, new initiatives have been introduced to make the financial system more robust. This includes Basel III policy recommendations which require that for bank sub-debt to be treated as capital it must be available to take losses when a bank is under severe stress. This could exclude these securities from any government bail-out, were that to happen. The Reserve Bank of NZ is responsible for interpreting and applying Basel III policy directives in NZ.

The key conclusion here is that subordinate bonds have characteristics that differentiate them from senior ranking bonds. These differences vary across securities and need to be appreciated.

ii) Variable Rate and Reset Securities

The term Reset Securities captures securities where the coupon rate will vary through time. The most conventional is a Floating Rate Note (FRN), where the coupon rate is typically reset every 3 months, based on the prevailing 90-day Bank Bill Rate plus an agreed margin. The agreed margin is established for the life of the security when the

original bond terms are established. However, in NZ we also see securities where the coupon is reset annually or even once every 3 or 5 years.

In the present low interest rate environment, the low coupon rates on reset securities have caused them to be out of favour with retail investors. While low market rates explain the lower coupons paid, lower rates do not, of themselves, explain the fall in the price of many of these securities. This has happened because the credit spread has widened.

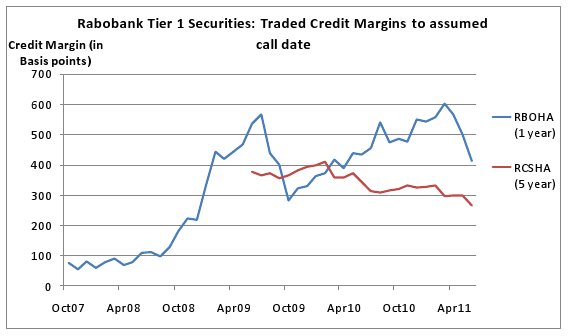

An interesting example can be seen by comparing two subordinate Rabobank securities. These are RBOHA and RBSHA on NZDX. They rank equally with each other however they have different coupon structures. RBOHA has an annual coupon reset, so actual coupons have been lower for the last 3 years while the Official Cash Rate has been low. The coupon is currently 4.211%. RCSHA has a 5 year coupon reset, so currently enjoys the 8.786% coupon initially set in May 2009. However, regardless of actual coupon, we believe the market should trade these securities at a similar credit spread, as their credit risk is essentially the same. In fact due to the RBOHA‟s earlier estimated call date, it should trade with a slightly smaller credit spread. However, as the chart below shows, the reverse applies and the gap in credit spread has been quite significant. Early in 2011 the estimated credit spread for RBOHA was 6%, whereas RCSHA was 3%.

Source: Bloomberg, Harbour Asset Management

Source: Bloomberg, Harbour Asset Management

For a retail investor, where the actual coupon may seem the most „real‟ aspect of the bond, they might miss the point that RBOHA had become very cheap. Indeed lately, the price on RBOHA has risen from 74.00 in April to 83.50 at present. This is reflected in the narrowing in credit margin in the chart. The challenge for investors is that as securities such as RBOHA are traded in price terms on NZDX, one needs to do the maths to estimate the actual credit margin and determine which securities are expensive or cheap.

Reinforcing the message that the credit margin is a better valuation signal than using the coupon is the fact that in a portfolio, there are alternative ways to manage duration.

These can overcome the issue of the actual coupon being set at the lower point on the yield curve, as is the case with RBOHA. Most portfolio managers do this as a matter of course.

iii) Callable Bonds

Callable bonds are those where the Issuer has the right, but not the obligation, to repay the bonds prior to the designated maturity date. They can be simple or, as with some Capital Notes, rather convoluted. The important issue to recognise is that the call is an option held by the issuer and they will exercise this in their best interests. Typically, if a security is not called at a call date, the coupon will also be reset. Sometimes there will be a step-up, which increases the margin the issuer pays, thereby providing an incentive to call the bond.

An interesting dynamic of callable bonds relates to investor expectations. Banks are prohibited by the Reserve Bank from pre-advising any commitment to call bonds that qualify as regulatory capital, but other than exceptions by Deutsche Bank in 2009 and the National Bank in the 1990‟s, they have called all of their bonds at the first call date. This has set a strong precedent, which applies globally, even though a small minority of European banks broke this convention during the GFC. This precedent has often been observed in the interests of preserving good relations with the domestic funding base, even though the banks‟ financial incentive has been to not call the bond.

For corporate issuers the precedent of calling is less strong. The economic incentive for issuers to call a bond is tied to the prevailing cost of funding at the time of the call. Market-wide credit spreads are currently significantly wider than those that prevailed pre-GFC, when credit availability was abundant. That means for some debt deals issued before 2008, there is no financial incentive for issuers to call deals. In fact some perpetual deals are set at levels that argue the call option will not be exercised for a considerable time.

The impact of volatility and liquidity.

The GFC provided the market with a sharp reminder of the impact of volatility in markets. For corporate bonds, features such as subordination and coupon resets can appear rather benign at times, making it difficult to envisage the impact heightened volatility may bring. Market pricing over the last three years has shown the effects of volatility in interest rates and credit spreads. Finance companies have shown the effects of being subordinate lenders, although their problems were wider than subordination alone.

Another aspect of volatility is that under stress, credit securities can become increasingly highly correlated. This can undermine the effects of diversification. For subordinate securities, their status of sitting between senior debt and equity becomes more apparent. At a portfolio level, asset allocation into fixed interest is typically designed to preserve capital value and generate income even when markets are under stress. However, an excessive exposure to subordinate debt may fail to provide the performance required.

Another feature of sub-debt and of many issues that predominantly trade on NZDX, is that liquidity is or can become poor. This can mean transaction costs are high, or that a meaningful bid or offer just doesn‟t exist. Investors often overlook transaction costs and liquidity in their assessment of securities. Inadequate liquidity planning can have a significant impact on performance, as well as make it difficult for investors to realise the investment.

What role should sub-debt play in a portfolio?

A core belief we hold in investing in fixed income is that the premium available in a diversified portfolio of corporate bonds will more than compensate investors for the risks taken, over a medium to longer timeframe. In addition, research skills can uncover valuation-based opportunities to improve returns. The argument for investing in credit is more compelling when securities are held in a portfolio with good risk management procedures. We believe investors need to be able to identify and isolate the specific characteristics embedded in a given security, and be able to manage these risks at a portfolio level. When we construct a portfolio, we apply a maximum aggregate exposure to subordinate debt to reduce the risk that the fund will suffer alongside equities during market stress. In addition, by ensuring a portfolio has a core proportion of liquid assets, the higher-yielding and illiquid securities can be held with some confidence that they can be held for a considerable time without imposing high transaction costs.

The structural outlook for retail participation in the debt market in New Zealand

The retail, or direct-investor participation in subordinate debt is considerable, and is shown by the high weighting these securities have on NZDX. It is certainly noteworthy that these more complex securities are more heavily favoured by retail investors than by professional fund managers, especially as the fund managers have deeper resources and experience to analyse these securities, which by their nature often carry a higher degree of investment risk in terms of credit quality. While broking firms and several financial planning firms are also equipped to provide research on these securities, this is by no means universal. Perhaps prompted by the regulatory changes introduced under the Financial Advisors Act 2008, we have noticed a significant proportion of financial planners switching their clients fixed interest investments from direct securities to funds. The implication we draw from this observation is that the pool of capital available for retail deals may diminish, to the extent that these deals are not universally favoured by the funds and in some cases will not be eligible for some fund investment guidelines. The total market appetite for this type of security needs critical mass to support ongoing deals. A reduction in core appetite would be a negative development for the NZ capital market and certainly not what was envisaged by the Capital Markets Taskforce in the review conducted in 2010. A positive outcome would be if fund managers broadened their scope to include these securities. This would need support from asset consultants and their client base. Greater fund manager participation would arguably also improve the quality of deals that are presented, as their support would be conditional on more favourable terms than have been seen in many deals historically.

IMPORTANT NOTICE AND DISCLAIMER

This note is provided for general information purposes only. The information is given in good faith and has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation but its accuracy and completeness is not guaranteed. Information and any analysis, opinions or views contained herein reflect a judgement at the date of publication and are subject to change without notice. To the extent that any such information, analysis, opinions or views constitute advice, they do not take into account any person’s particular financial situation or goals and, accordingly, do not constitute personalised advice under the Financial Advisers Act 2008, nor do they constitute advice of a legal, tax, accounting or other nature to any persons. Investment in funds managed by Harbour Asset Management Limited can only be made using the Investment Statement, which should be read carefully before an investment decision is made. The price, value and income derived from investments may fluctuate in that values can go down as well as up and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Reference to taxation or the impact of taxation does not constitute tax advice. The rules on and bases of taxation can change. The value of any tax reliefs will depend on your circumstances. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. No person guarantees repayment of any capital or payment of any returns on capital invested in the funds. Actual performance will be affected by fund charges. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this presentation or its contents.

Thanks to Harbour Asset Management for allowing us to reproduce this article.

If you are interested in investing in Harbour Asset Management funds please contact one of our advisers on 07 578 3863 or email

- Last updated on .