Online Share Trading Platforms causing the Robinhood Effect

Weird things have been happening on share markets worldwide so far this year. In the US shares in companies facing bankruptcy like Hertz, JC Penny and Chesapeake Energy have been in demand. A company called Zoom Technologies went up by 240% (before it was suspended from trading) because it was confused with a completely different company that operated the Zoom meeting app which became extremely popular worldwide during the lock downs. Money poured into shares hit by the Corona-19 crisis like airlines and cruise liners. There is also unprecedented activity in small value shares - "penny dreadfuls". Normally the markets don't behave like this, experienced and professional investors do not undertake this sort of activity in such volumes across the board. Some are seriously concerned because to us it is really hard to understand why!

The Robinhood Effect

The term "The Robinhood effect" has been coined to try to explain the remarkable trading on world share markets, particularly in the US so far this year. It is named after a popular online share trading platform called Robinhood which has really taken off and is the one making the headlines which helps increase it's popularity. Part of Robinhoods appeal is their "take from the rich and give to the poor" and "Stick it to the Establishment" themes in their marketing.

Should we Blame Covid-19 and the Millennials?

This new phenomenon is being driven by the increased use of the low cost online share trading platforms believed to be largely driven by "Millennials" - people born from 1980 ro 2000. Millennials are now entering the work force, earning money and some have started using online share platforms. These people are generally extremely comfortable with technology and have no hesitation transacting online. Many are heavy users of social media. They may or may not be financially sophisticated but they are certainly not very experienced investors. I asked my twenty something daughters and yes, they both have friends using these platforms. It is clear that Millennials are using these platforms but so are many other demographic groups.

Use of the online platforms boomed during the Covid-19 lock downs. A combination of factors creating the perfect environment for their adoption to a much wider audience. Big share price falls at the beginning of the crisis and subsequent big share price rises piqued peoples interest as people started sharing stories on social media how easy it was to make profits. People were looking for something to do. Believe it or not it is thought that with very little live sport to bet on some of those people doing on-line sports betting turned to trading on the share market instead! As reported in the NZ Herald there is a US sports blogger call David Portnoy who turned to Robinhood to get his personal gambling fix. He reported his profits on social media and now hundreds of thousands of people are believed to be following his advise. Some say they are investing, others call it gambling. I doubt that many of his followers are Millennials.

Analysis has shown Robinhood investors poured money into the share market right at the bottom of the March 2020 price crash. And have continued to increase ever since. It appears that as a group their timing was impeccable and many have made very nice profits trading shares. But no doubt many have lost money as well.

Is it such a terrible thing?

Many investment market commentators seem to think this is a terrible thing. "The Establishment" doesn't like new things coming along they can't make money off. No doubt some of these Millennials will lose some money and be scared off the share market for good. But some wont, some will just treat it as a bit of cheap harmless fun and some will treat it seriously and learn to build a portfolio over the long term to help them with their retirement. None of us are getting much of a return from bank interest rates.

The platforms aren't restricted to Millennials, there isn't a maximum age limit I'm aware of. Older people who haven't bought share before will use the platforms and use them to build decent share portfolios and supplement their income at a low cost. Some existing share investors will use them to save on paying brokerage (to people like us) and simplify their reporting.

Online platforms certainly seem to have changing the dynamics of the market so far this year. I think the platforms are here to stay and more traditional investors will have to adapt their thinking. Hopefully understanding what is going on will help us make wise decisions. Some of us will follow the herd and benefit others might keep well out of its way and not get caught in the stampede.

What is Robinhood Anyway?

Robinhood is a US based online share trading platform that launched in 2013 and has added three million new users in the first four months of the year. Robinhood users (investors?) can buy and sell securities - "commission free". Robinhood don't have offices you can visit, they are online only. This keeps cost down. They have very, very sophisticated computer platforms. Almost everything is automated and is accessed over the internet. Robinhood is only available to people based in the USA but many countries now have companies offering similar services. There are many other platforms but Robinhood has really taken off and is the one making the headlines which helps increase it's popularity.

Online Share Trading Platforms in New Zealand

In the first half of this year retail investors are reported to be doing unprecedented levels of the trading activity on the NZ share market. Usually it is wholesale investors, the professional full time investors such as fund managers that dominate trading. Analysis of trading volumes points to the online platforms having an influence. As the online platforms don't charge a minimum fee it is now economic to trade very small amounts even fractions of shares. All those small trades add up and influence the price. Retail investors can now buy and sell and take profits (or losses) on quite small share price movements and not have the fixed buy and sell costs. Using these services there is also no problem with a minimum share holding number enforced by companies on individual share holders.

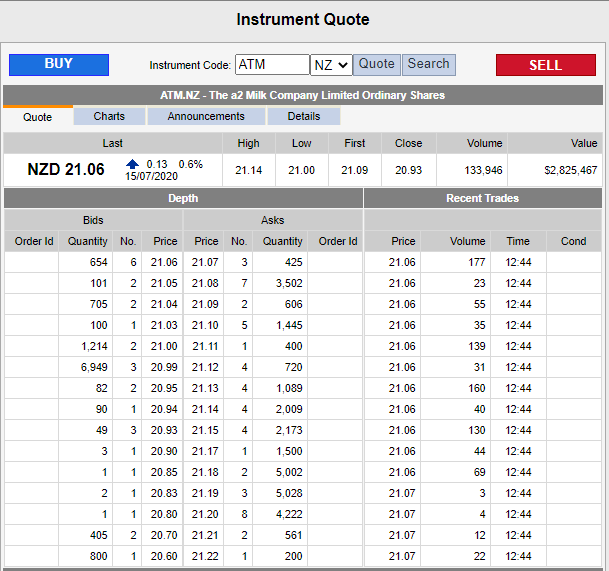

Online platforms certainly appear to be a factor in New Zealand as well. In his column on 28 June 2020 - "This way lies market madness", Rod Oram reported that "In the past year, Sharesies’s share of retail trading transactions on the NZX has gone from zero to 27 percent, but its share of retail trading value has gone from zero to less than 3 percent". That means lots of small transactions. On some days we look at the order volumes on the NZ stock exchange and both the buy and sell columns are filled with single digit orders which was unheard of until recently. Most traditional share brokers charge a flat minimum fee with a percentage brokerage fee based on value on top of that. It didn't make sense to buy one a2 Milk share at $21 if you were going to pay another $50 on top but with the online platforms you can and people are. Below is a snapshot of the NZX a2 Milk quotes as I write this on the morning of 16 July 2020:

On the bottom left under "Depth" in the "Bids" column (buys) you can see a line for an order to buy three shares at $20.90 and below that an order for one share at $20.85. Orders this size were unheard of before the advent of the online platforms. It was simply uneconomic for investors and it would have been madness for traders to then sell them again. You would have had to get a price of more than $120 if you wanted to sell and take a profit because you had to pay the fixed fee on the sell as well.

three shares at $20.90 and below that an order for one share at $20.85. Orders this size were unheard of before the advent of the online platforms. It was simply uneconomic for investors and it would have been madness for traders to then sell them again. You would have had to get a price of more than $120 if you wanted to sell and take a profit because you had to pay the fixed fee on the sell as well.

That buy order for three shares at $20.90 is almost certainly from an online platform and perhaps represents many small orders from that platform's users.

To experience it first hand I opened a Sharesies account a couple of weeks ago. I put in $20 and invested $2 in 10 different companies. I bought 0.103645 a2 Milk shares. Yes, you did read that right, I bought just over one tenth of one a2 Milk share for a total cost of $2. They were about $20 each at the time. I paid a fee of 1 cent for each transaction or 0.5%.

It wasn't hard to open the account only took a few minutes. I had a scan of my passport available to prove my identity. They also work with Drivers Licences and other forms of ID and can be done online. I transferred the money from my bank account using internet banking and next day when the money had gone through from my bank to Sharesies I placed the orders and the following day it was all done.

When buying you pick a share you want and a dollar value you want to invest. You can set a price or accept market price. If selling you select the number you want to sell and again you can accept market price or set a price limit. It appears transactions are processed overnight. I don't think you can "day trade" using Sharesies.

The transaction fee drops to 0.1% for orders over $3,000. Once the balance of your Sharesies investments gets over $50 you pay $1.50 a month up to $3,000 and $3.00 a month if your balance is over $3000. Or you can pay a flat $30 a year. The transaction fees are very low but the subscription fees on small balances is expensive. The $1.50 a monthly subscription fee on a $500 balance would be 3.60%. On a balance over $3,000 it would make most sense to go for the flat $30 a year fee which would be 1.0% and reduces as a percentage as your balance gets bigger. If you had $300,000 you'd still only pay $30 and that is negligible on a portfolio that size.

You get access to simple reports and they collect dividends for you and credit them to your account. It has yet to be tested but I suspect the IRD will be keeping an eye on Sharesies, If people are just trading for profit the IRD can classify them as "Traders" and deem their profits to be income and therefore taxable.

My Sharesies portfolio is now worth $21.69 which is a nice percentage gain over a couple of weeks. Helped by a2 Milk which are now worth $2.19 which is a not much in dollars but a nice % profit. But not as much profit as I would have made if I'd kept the 8,750 a2 shares I bought in 2008 for a little over 10 cents instead of selling them for a measly 45 cents in 2012. Now they'd be worth over $180,000!

If you want to get into the action - with money you can afford to lose - there are a few options. Currently in New Zealand our nearest equivalents to Robinhood are Sharesies, Hatch and the newest entry Stake, which looks interesting. ASB Securities and Direct Broking (owned by NZ's biggest share broker - Jarden) are traditional style brokers that also have online options. I have a Direct Broking account and we use them to facilitate our customers shares transactions.

InvestNow is also an online platform I particularly like. But InvestNow doesn't offer direct buying of shares. InvestNow offer a wide range of managed funds, term deposits and ETFs.

On MoneyHub.co.nz there is an article Comparing Sharesies vs Investnow vs Hatch vs ASB Securities vs Direct Broking and more, which discusses the pros, cons and costs of Sharesies, InvestNow, Hatch, ASB Securities and Direct Broking comparing these platforms offerings.

Disclosure of interest: if you click on one of those green Sharesies links in this article and subsequently open an account Sharesies will put $5.00 of their money in my account and I can buy some more shares! It doesn't cost you anything.

As always there are risks associated with investing and using a third party to do it for you adds to those risks. Do your research before you commit too much money and please do not invest more than you can afford to lose.

- Last updated on .