More to fixed interest than just interest rates.

There’s a lot more to choosing a term investment than simply looking for the best rate on offer.

There’s a lot more to choosing a term investment than simply looking for the best rate on offer.

As we all know there is no investment that is totally free of risk, and on this basis, New Zealand securities law actually prohibits using the word ‘safe’ and limits the word ‘guaranteed’ in an advertisement or offer for financial products.

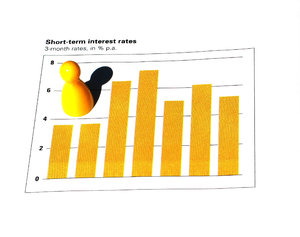

All investments involve some trade-off between risk and return. While bonds and deposits may feel a more secure form of investment than some other asset types, they cannot be considered fully secure. Therefore, an investment offering returns significantly higher than a reasonable margin over the current 'official cash rate' (OCR), there is likely to be good reason for it.

You need to find out just what those reasons are, before you can make an informed decision. Remember, always read the fine print or better still take some advice from somebody independent of the investment being considered. Remember you can always talk to one of our advisers on 07 578 3863.

When looking at a fixed interest investment, as well as finding out about the term and promised returns, you should ask three main questions:

- Who will I really be lending my money to?

- What will they really use it for? And,

- What security will I have, if any?

First, who is involved? The higher the credit-worthiness of the borrower, the greater your security. Once you look beyond the Government, State Owned Enterprises and local authorities and the main Banks you need a higher degree of caution. Ask, for instance, whether the borrower has a credit rating from a recognised ratings agency.

Second, look at what your money will be used for, and check how the borrower proposes to pay your interest payments and eventually, repay your original capital. For example, with some corporate fixed interest bonds, the borrower may depend on achieving a certain level of business performance to meet its investors’ income expectations. If that target isn’t met, investors can be badly affected. On the other hand, with Government stock or a main bank, you can reasonably expect your lower interest payments to be as regular as clockwork, as well as the eventual repayment of your capital.

Finally, the third question: What securities or guarantees are there? If something is advertised as ‘guaranteed’, check to see just what this means. Under law, only a genuine third party can offer a guarantee – the borrower can’t act as its own guarantor.

Also, check to see if your investment would be ‘secured’ or ‘unsecured’. If secured, is it by a first-ranking mortgage, second mortgage or a mix or other security? Also, some finance companies have an insurance plan in place to help should something go wrong. Remember that unsecured creditors (investors!) will be the last to get paid.

Finally, for added security, if you are looking at a higher risk/return investment, make sure there is independent advice available or at least an independent trustee or custodian looking after the money – and your best interests.

- Last updated on .