5 Things to Ask Before Moving Your KiwiSaver

The FMA has released a "guidance note" that makes it easier for NZ Financial Advisers to give advise on KiwiSaver.

The FMA has now said we can tell people a lot more without it being classified as "personalised financial advise" which means we don't have to do a full financial review before talking to people about their individual KiwiSaver situation.

On balance we see this as a good thing, more people will get the advise they need. We will definitely be able to provide more useful advise to people without spending time doing unnecessary paperwork to make sure we aren't prosecuted. However it is likely this will result in more people offering advise, and some of those people may not be entirely scrupulous. So the FMA has also released information for the public - five things you should ask before moving your KiwiSaver.

Some KiwiSaver providers will pay advisers an upfront fee if they help an investor transfer their account. Most providers pay advisers a "trail fee" for KiwiSaver accounts under their care. The amounts can be quite substantial and are paid to the advisers to look after the interests of you - the investor. It saves the providers having to do so.

Because advisers can get paid to transfer peoples KiwiSaver accounts you should consider their motives if they are telling you to move. The change may not benefit you but will benefit the Adviser. Remember you are ENTITLED to be told by the adviser of any money they will get if you do what they suggest.

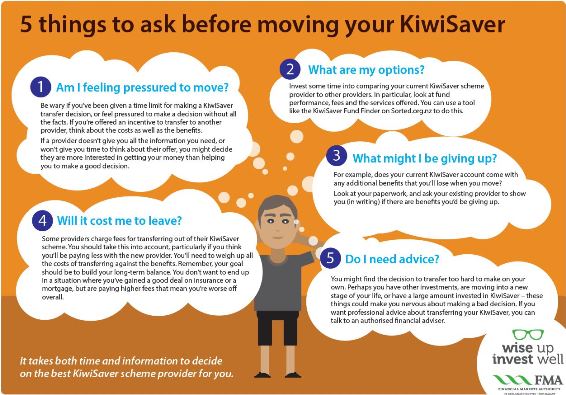

- Am I feeling pressured to move?

Be wary if you’ve been given a time limit for making a KiwiSaver transfer decision, or feel pressured to make a decision without all the facts. If you’re offered an incentive to transfer to another provider, think about the costs as well as the benefits.

If a provider doesn’t give you all the information you need, or won’t give you time to think about their offer, you might decide they are more interested in getting your money than helping you to make a good decision. - What are my options?

Invest some time in comparing your current KiwiSaver scheme provider to other providers. In particular, look at fund performance, fees and the services offered. You can use a tool like the KiwiSaver Fund Finder on Sorted.org.nz to do this. - What might I be giving up?

For example, does your current KiwiSaver account come with any additional benefits that you’ll lose when you move?

Look at your paperwork, and ask your existing provider to show you (in writing) if there are benefits you’d be giving up. - Will it cost me to leave?

Some providers charge fees for transferring out of their KiwiSaver scheme. You should take this into account, particularly if you think you’ll be paying less with the new provider. You’ll need to weigh up all the costs of transferring against the benefits. Remember, your goal should be to build your long-term balance. You don’t want to end up in a situation where you’ve gained a good deal on insurance or a mortgage, but are paying higher fees that mean you’re worse off overall. - Do I need advice?

You might find the decision to transfer too hard to make on your own. Perhaps you have other investments, are moving into a new stage of your life, or have a large amount invested in KiwiSaver – these things could make you nervous about making a bad decision. If you want professional advice about transferring your KiwiSaver, you can talk to a financial adviser. GIve us a call on 07 578 3863 or emailThis email address is being protected from spambots. You need JavaScript enabled to view it. we'll probably be able to help you.

- Last updated on .