View:

June 12, 2025

June 11, 2025

USD flows: US-China trade progress fails to impress

11 June 2025 - 19:17

Even with a surprisingly subdued CPI to welcome, equities have not been as positive on the US-China trade progress as was Trump, with China’s 6-month limit on rare-earth export licenses suggesting they wish to maintain some leverage. USD weakness has resumed after the post-CPI dip was followed by

U.S. Budget Deficit falls in May, Tariffs explaining over half of the narrowing

11 June 2025 - 18:28

May saw a budget deficit of $316bn, down from $347.1bn in May 2024, though the deficit in the fiscal year to date of $1364.7bn is up from $1202.3bn in the eight months to May 2024. The 12-month average has however slipped below $2trillion for the first time in the current fiscal year. The deficit in

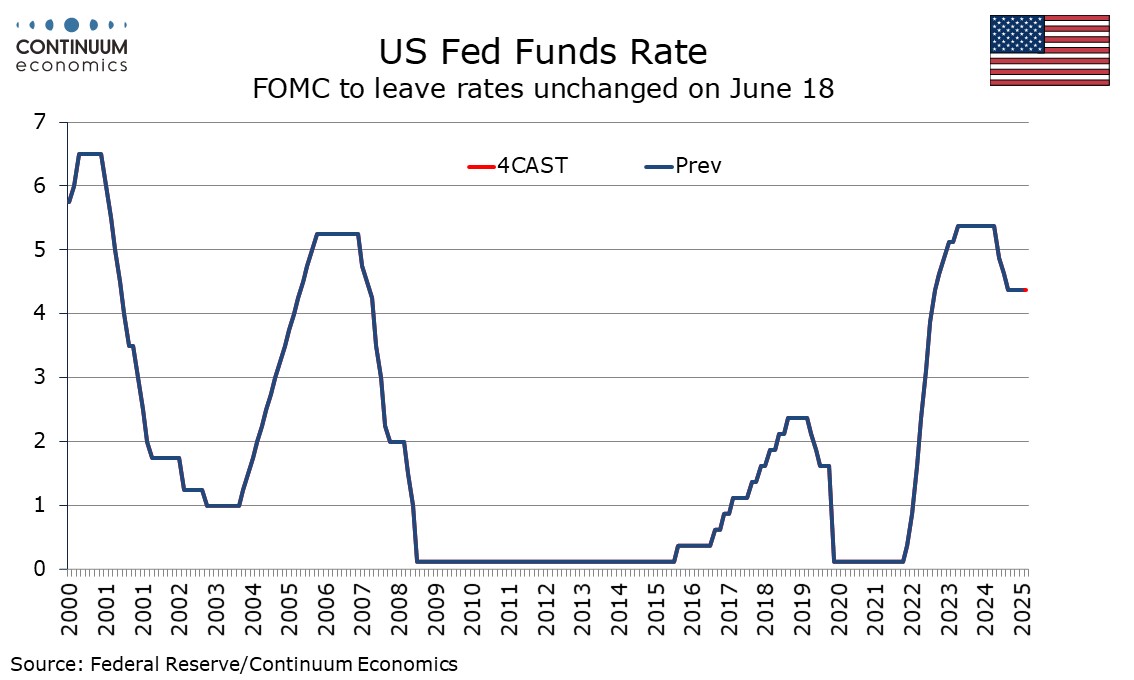

FOMC Preview for June 18: No change in rates or dots, only marginal changes to statement and forecasts

11 June 2025 - 16:01

The June 18 FOMC meeting looks highly likely to leave rates unchanged at 4.25-4.5%. We expect only marginal changes to May’s statement and the Fed’s median forecasts from March, with no change at all in the median dots on rates. Chairman Powell at the press conference may welcome recent signal

Preview: Due June 12 - U.S. May PPI - A correction from a weak April, which may be revised

11 June 2025 - 13:07

We expect May PPI to see a modest bounce from a weak April with a 0.2% rise overall and a 0.3% increase ex food and energy. Ex food, energy and trade, we expect a rise of 0.2%. April fell by 0.5% overall and ex food and energy, but by only 0.1% ex food, energy and trade. A weak March was revised u

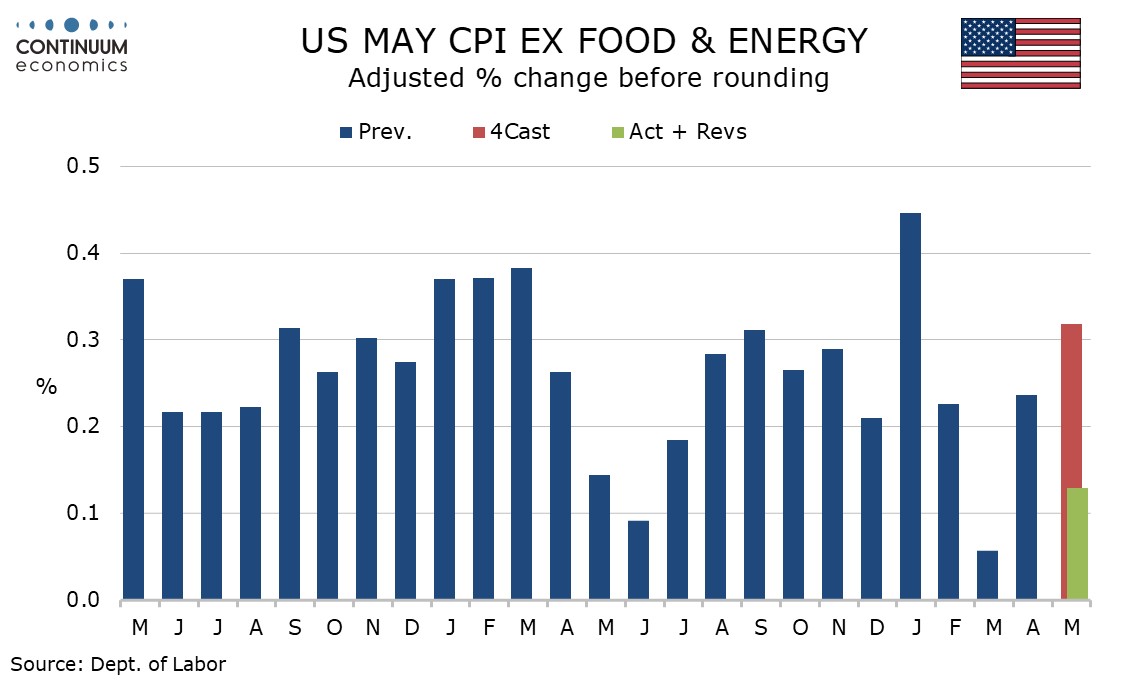

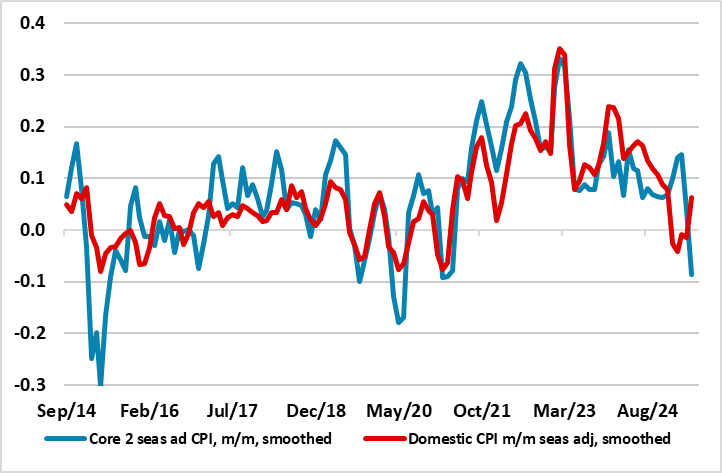

U.S. May CPI - Little tariff pass-through, with inflationary pressures elsewhere fading

11 June 2025 - 12:59

May CPI has surprised significantly to the downside, up only 0.1% both headline and core, with the respective gains before rounding being 0.08% and 0.13%. The data is subdued across the board, with commodities ex food and energy unchanged despite tariffs and services ex energy on the low side of tre

SNB Preview (Jun 19): Toying With Being Negative?

11 June 2025 - 09:23

A further 25 bp cut (to zero) in the SNB policy rate on Jun 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX int